Magdalene Chia

ASSOCIATE GROUP DIRECTOR

CEA NO. : R015186Z

For media enquiries, please contact corpcomms@propnex.com.

Latest Property Real Estate News - Published on 01/07/2024

01 July 2024, Singapore - Flash estimates released today showed that private residential property prices saw slower growth in Q2 2024 amidst muted private home sales, while HDB resale flat prices rose at a faster clip from Q1 to Q2 2024 as transaction volume rose. Meanwhile, the number of HDB resale flats that changed hands for at least $1 million hit yet another new high in Q2 2024, with two transactions fetching record resale price. The final print for the quarterly real estate statistics will be released on 26 July 2024.

Q2 2024 URA Private Residential Property Index (FLASH)

Flash estimates from the Urban Redevelopment Authority (URA) showed that overall private home prices rose by 1.1% QOQ in Q2 2024, marking the fourth straight quarterly increase following the 1.4% QOQ increase in Q1 2024, 2.8% QOQ growth in Q4 2023, and 0.8% QOQ uptick in Q3 2023, and (see Table 1). The slower price growth came as private home sales were relatively flat in Q2 2024. Based on the flash estimates, private home prices have risen by a cumulative 2.5% in 1H 2024, slower than the 3.1% increase in 1H 2023.

Table 1: URA Private Property Price Index

| Price Indices | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q4 2023 | Q1 2024

| Q2 2024 Flash

|

| (QOQ % Change) | (YOY % Change) | (QOQ % Change) | |||||

| Overall PPI | 3.3 | -0.2 | 0.8 | 2.8 | 6.8 | 1.4 | 1.1 |

| Landed | 5.9 | 1.1 | -3.6 | 4.6 | 8.0 | 2.6 | 1.8 |

| Non-Landed | 2.6 | -0.6 | 2.2 | 2.3 | 6.6 | 1.0 | 0.9 |

| 0.8 | -0.1 | -2.7 | 3.9 | 1.9 | 3.4 | -0.2 |

| 4.4 | -2.5 | 2.1 | -0.8 | 3.1 | 0.3 | 2.2 |

| 1.9 | 1.2 | 5.5 | 4.5 | 13.7 | 0.2 | 0.3 |

Source: PropNex Research, URA

A slight price growth was observed in the non-landed private homes segment in Q2 2024, where prices crept up by 0.9% QOQ, based on the flash estimates. Within the non-landed homes segment, private home prices in the Core Central Region (CCR) fell marginally by 0.2% QOQ, perhaps owing to the higher base in the previous quarter, where CCR prices climbed by 3.4% QOQ. By contrast, the Rest of Central Region (RCR) and Outside Central Region (OCR) saw non-landed private home prices rise by 2.2% QOQ and 0.3% QOQ, respectively in Q2 2024. It appears that prices in the OCR could possibly be peaking in view of two quarters of marginal growths in Q1 and Q2 2024.

Meanwhile, the prices of private landed homes climbed by 1.8% QOQ in Q2 2024 as per flash estimates - representing the third consecutive quarter of price increase for landed homes. Cumulatively, landed home prices have climbed by 4.5% in 1H 2024, compared with 7% in 1H 2023. According to URA Realis caveat data, the average transacted unit price of detached homes, semi-detached homes, and terrace houses all rose from Q1 to Q2 2024, with sales volumes rising across all three landed home segments.

The URA said that the overall private home transaction volume in Q2 2024 (up to mid-June) came in at 4,215 units- relatively on par with the 4,230 units in Q1 2024. Looking at the URA Realis caveats data and monthly developers' sales data, PropNex notes that private housing developers sold 694 new private homes (ex. EC) in Q2 2024 (till 23 June). The top-selling new private residential projects in Q2 2024 were The Botany at Dairy Farm which sold 85 units, Hillhaven which shifted 61 units, and Lentor Hills Residences, where 55 units were transacted, based on caveats lodged. With a lack of project launches, developers' sales look unlikely to cross the 1,000-unit mark in Q2 2024. Factoring the 1,164 units shifted in Q1 2024, developers sold over 1,850 new units (ex. EC) in the year-to-23 June 2024 period.

Over in the private residential resale market, URA Realis caveat data showed that 3,073 private homes (ex. EC) were resold in Q2 2024 (till 23 June) - already surpassing the 2,689 resale private homes transacted in Q1 2024. One factor that is supporting resale demand is perhaps the sizable price gap between new sales and resale homes, with the latter seen as more affordable by some buyers. According to caveats lodged, the overall median transacted unit price gap between new private homes (landed and non-landed, ex. EC) at $2,243 psf and that of resale private homes at $1,675 psf was 34% in Q2 2024.

Mr Ismail Gafoor, CEO of PropNex Realty:

"Private home sales, particularly developers' sales have been muted, and this is largely due to the limited number new project launches in Q2 2024. Many of the fresh launches during the quarter have been boutique developments that offer fewer units, while the project with the largest number of units launched in Q2 was the 190-unit Skywaters Residences, which is at the top-end of the market and unlikely to fit the budget of most buyers here. Meanwhile, The Hill @ One North, has sold about 30% of its 142 units since its launch in April 2024.

Apart from the lack of major launches in the quarter, we think some buyers may also be holding out for more projects to come onstream later in the year, so that they can widen their options. Based on our observations from the numerous consumer seminars, and property expo talks that were conducted in the past months, there is still a lot of interest in private residential properties, but prospective buyers are seeking more clarity on how prices will move, and also to check out other projects, as more new launches come on the market.

Some of the new projects that could be rolled out in Q3 2024 include Sora in Yuan Ching Road, Kassia in Flora Drive, Emerald of Katong in Jalan Tembusu, The Chuan Park, Arina East Residences in Tanjong Rhu, the Bukit Timah Link project, Meyer Blue, and Union Square Residences which can collectively offer more than 3,300 new private residential units.

In view of the slow sales in Q2, PropNex has revised downwards our projection for new private home sales to around 6,000 to 6,500 units (ex. EC), from our initial forecast of 7,000 to 7,500 units (ex. EC). We remain optimistic that developers' sales will pick up in Q3 2024, as several more sizable projects are expected to be launched for sale. For the full year 2024, we project that the overall private home prices could rise by 4% to 5% - slowing from the 6.8% increase in 2023.

Table 2: Non-landed new private home sales and non-landed private home resale (ex. EC) by nationality by residential status by Quarter

| Nationality by Residential Status | 2022Q1 | 2022Q2 | 2022Q3 | 2022Q4 | 2023Q1 | 2023Q2 | 2023Q3 | 2023Q4 | 2024Q1 | 2024Q2 |

| Company | 0.1% | 0.2% | 0.1% | 0.2% | 0.7% | 0.1% | 0.1% | 0.1% | 0.0% | 0.1% |

| Foreigner (NPR) | 3.1% | 4.9% | 4.7% | 7.2% | 7.2% | 4.2% | 1.8% | 1.8% | 1.2% | 2.1% |

| Singapore Permanent Residents (PR) | 18.0% | 17.1% | 15.9% | 20.8% | 19.9% | 16.1% | 16.7% | 16.4% | 16.3% | 19.3% |

| Singaporean | 78.7% | 77.9% | 79.2% | 71.8% | 72.2% | 79.5% | 81.4% | 81.8% | 82.5% | 78.5% |

Source: PropNex Research, URA Realis

In Q2 2024, foreigners (non-PR) made up 2.1% of the total non-landed private new sale and private resale home transactions (ex. EC), based on URA Realis caveat data (see Table 2). This is up from the 1.2% proportion in the previous quarter. In absolute terms, there were 70 transactions to foreigners in Q2 2024, compared with 44 in Q1 2024. Of the 70 transactions, 43 are properties in the CCR, including six units at Klimt Cairnhill, four units at Cuscaden Reserve and three units each at Watten House, and The Residences at W Singapore Sentosa Cove. Meanwhile, the proportion of Singaporean buyers moderated to 78.5% in Q2 2024 from 82.5% in the previous quarter, while Singapore PRs accounted for around 19% of the transactions in Q2."

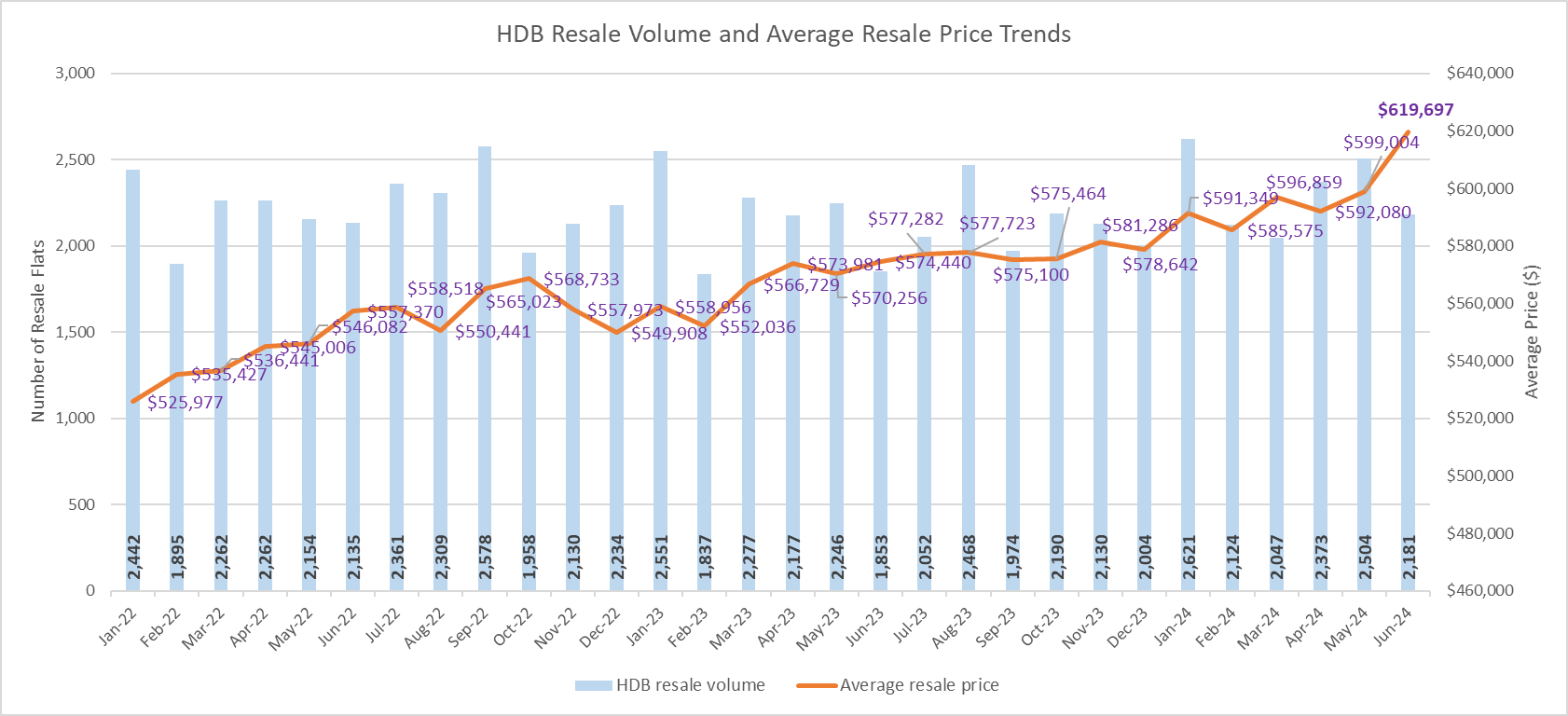

Q2 2024 HDB Resale Price Index (FLASH)

Meanwhile, flash estimates released by the Housing and Development Board (HDB) showed that resale flat prices rose by a stronger 2.1% QOQ in Q2 2024, following the 1.8% QOQ growth in the previous quarter. This represents the fastest pace of quarterly increase in six quarters (see Table 3), since the 2.3% QOQ growth recorded in Q4 2022. Cumulatively, the HDB resale price index has risen by 4% in 1H 2024 - higher than the 2.5% increase achieved in 1H 2023.

The HDB said there were 7,208 HDB flats resold in Q2 2024 (till 27 June) - up by 14.5% from 6,297 resale flats transacted over the same period last year. Including the 7,068 flats resold in Q1 2024, there have been more than 14,200 resale flats transacted in the year to 27 June 2024 period. PropNex projects that around 27,000 to 28,000 resale flats could be sold in 2024 -up from 26,735 units resold in 2023.

Table 3: HDB Resale Price Index

| Quarter | QOQ % change | YOY % change |

| Q1 2021 | 3.0% | 8.1% |

| Q2 2021 | 3.0% | 11.0% |

| Q3 2021 | 2.9% | 12.5% |

| Q4 2021 | 3.4% | 12.7% |

| Q1 2022 | 2.4% | 12.2% |

| Q2 2022 | 2.8% | 12.0% |

| Q3 2022 | 2.6% | 11.6% |

| Q4 2022 | 2.3% | 10.4% |

| Q1 2023 | 1.0% | 8.8% |

| Q2 2023 | 1.5% | 7.5% |

| Q3 2023 | 1.3% | 6.2% |

| Q4 2023 | 1.1% | 4.9% |

| Q1 2024 | 1.8% | 5.8% |

| Q2 2024 (Flash) | 2.1% | 6.5% |

Source: PropNex Research, HDB

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty said:

"The HDB resale flat price index has now risen for 17th consecutive quarters, or just over 4 years. We note that the pace of price growth has picked up slightly this year, after moderating somewhat in 2023. The resale price increase of 2.1% QOQ in Q2 2024, and 1.8% QOQ in Q1 2024 reflect the two fastest pace of quarterly price growth since Q4 2022, where prices rose by 2.3% QOQ. We believe the rebound in HDB resale flat transactions due to healthy demand for resale flats have helped to propped up prices. Notably, there have also been a higher number of flats resold for at least $1 million in Q2 2024. For the whole of 2024, we now project that HDB resale prices could rise by around 6% to 7%, a tad higher than the 4.9% increase in 2023.

Based on resale flat transaction data (retrieved on 1 July), the average resale prices rose across various flat types from Q1 2024 to Q2 2024 (see Table 4), posting growths of between 1.5% QOQ and 3.2% QOQ. We note that the average resale prices of 2- to 5-room flats, as well as that of executive flats in Q2 2024 are at their highest since 1990 (see figures in boldface in Table 4).

Table 4: Average transacted HDB resale prices by flat type by quarter

| Average transacted HDB resale prices | ||||||

| 1 ROOM | 2 ROOM | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE | |

| 2023Q2 | $245,500 | $321,255 | $410,084 | $579,723 | $685,707 | $827,549 |

| 2023Q3 | $324,315 | $413,024 | $590,299 | $689,904 | $837,138 | |

| 2023Q4 | $243,333 | $324,748 | $415,632 | $594,333 | $693,712 | $839,293 |

| 2024Q1 | $230,000 | $330,081 | $422,850 | $601,873 | $704,133 | $854,230 |

| 2024Q2 | $237,333 | $335,867 | $434,328 | $616,791 | $723,624 | $867,456 |

| QOQ % change in average resale prices | ||||||

| 1 ROOM | 2 ROOM | 3 ROOM | 4 ROOM | 5 ROOM | EXECUTIVE | |

| 2023Q2 | 3.6% | 1.9% | 0.3% | 1.4% | 1.9% | 1.7% |

| 2023Q3 | - | 1.0% | 0.7% | 1.8% | 0.6% | 1.2% |

| 2023Q4 | - | 0.1% | 0.6% | 0.7% | 0.6% | 0.3% |

| 2024Q1 | -5.5% | 1.6% | 1.7% | 1.3% | 1.5% | 1.8% |

| 2024Q2 | 3.2% | 1.8% | 2.7% | 2.5% | 2.8% | 1.5% |

Source: PropNex Research, Data.gov.sg (table excludes multi-gen flats); data retrieved 1 July 2024

A few records came tumbling where HDB million-dollar resale flats are concerned. The number of resale flats sold for at least $1 million hit a new quarterly high in Q2 2024 at 236 units - up by about 29% from 183 such flats sold in the previous quarter (see Chart 1). This takes the number of such flats transacted to 419 units in the first six months of the year - and it looks likely to breach the record of 469 units resold in 2023, possibly as early as July. In Q2 2024, million-dollar resale flats made up around 3.3% of the quarter's sales, based on transaction data.

Meanwhile, two 5-room resale flats in Bukit Merah - one in Boon Tiong Road, and the other in Henderson Road - became the joint most expensive resale flats ever transacted, fetching $1.588 million each. This has smashed the previous record of $1.569 million for a DBSS (design, build, and sell scheme) 5-room resale flat in Lorong 1A Toa Payoh that was transacted in January 2024.

Of the 236 units of million-dollar resale flats sold in Q2 2024, there were 77 units of 4-room flats, 96 units of 5-room flats, and 61 units of executive flats - marking the highest number of such flats to be sold in each respective flat type. The other two units were a 3-room flat and a multi-generation flat.

The number of million-dollar flats resold picked up more strongly in Q1 2024 and remained elevated in Q2 2024. Although we do not have the details of the buyers of such flats, it is possible that former private home owners who have sat out the 15-month wait-out period could have returned to the market and pushed up the sales number. The 15-month wait-out period was introduced in September 2022, and some of those who have been kept away could have served out that restricted period by January 2024.

Chart 1: Number of HDB resale flats sold for at least $1 million by quarter

Looking ahead, we expect the demand for HDB resale flats to remain resilient for the rest of the year, with the overall annual HDB resale volume possibly coming in at 27,000 to 28,000 units in 2024. That said, the HDB is expected to launch about 8,500 new flats for sale under its Build-to-Order (BTO) exercise in October. The offerings will feature several attractive sites, including in Kembangan, Bayshore, Kallang Whampoa, Pasir Ris, and Ang Mo Kio. These could potentially draw some buyers away from the HDB resale market, particularly those who do not mind waiting some years to get their new home."